Auto tax depreciation calculator

Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Business use percentage if less than 100 depreciation method you want to use.

Free Macrs Depreciation Calculator For Excel

A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. According to the general rule you calculate depreciation over a six-year span as follows. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

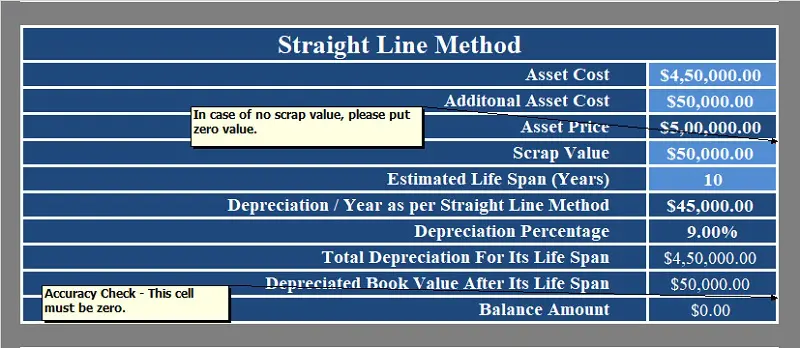

Example Calculation Using the Section 179 Calculator. Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead.

D i C R i Where Di is the depreciation in year i C is the original purchase price or. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Before you use this tool.

The depreciation is calculated by applying the vehicles depreciation. Section 179 deduction dollar limits. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Cost x Days held 365 x 100 Effective. We will even custom tailor the results based upon just a few of. By entering a few details such as price vehicle age and usage and time of your ownership we.

Depreciation Calculators The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. MACRS Depreciation Calculator Help.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. Alternatively if you use the actual cost method you may take deductions for. Use this depreciation calculator to forecast the value loss for a new or used car.

Using the values from the example above if the. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Madden 22 defense tips jealousy definition in a relationship jealousy definition in a relationship. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. This limit is reduced by the amount by which the cost of.

Years 4 and 5 1152. Cost or adjusted tax value. Calculate your vehicle depreciation Determine how your vehicles value will change over the time you own it using this tool.

The tool includes updates to. And if you want to calculate the depreciation youll also need to know the. Depreciation formula The Car Depreciation.

Homes for sale mt shasta. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. The Platform That Drives Efficiencies.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. Year 1 20 of the cost.

SLD is easy to calculate because it simply takes the. The Platform That Drives Efficiencies. Above is the best source of help.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

Macrs Depreciation Calculator Straight Line Double Declining

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Macrs Depreciation Calculator

Depreciation Schedule Template For Straight Line And Declining Balance

Car Depreciation Rate And Idv Calculator Mintwise

Macrs Depreciation Calculator Based On Irs Publication 946

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Irs Publication 946

Car Depreciation Calculator

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate